LSTM based Algorithmic Trading model for Bitcoin

Join the Buffalo Computer Society Chapter in welcoming Distinguished Visitor, Tulsi Thulasiram, on Monday January 29, at 5 PM CST/6 PM ET, when he gives a virtual presentation for our new series, Neural Networks of AI.

Topic Summary:

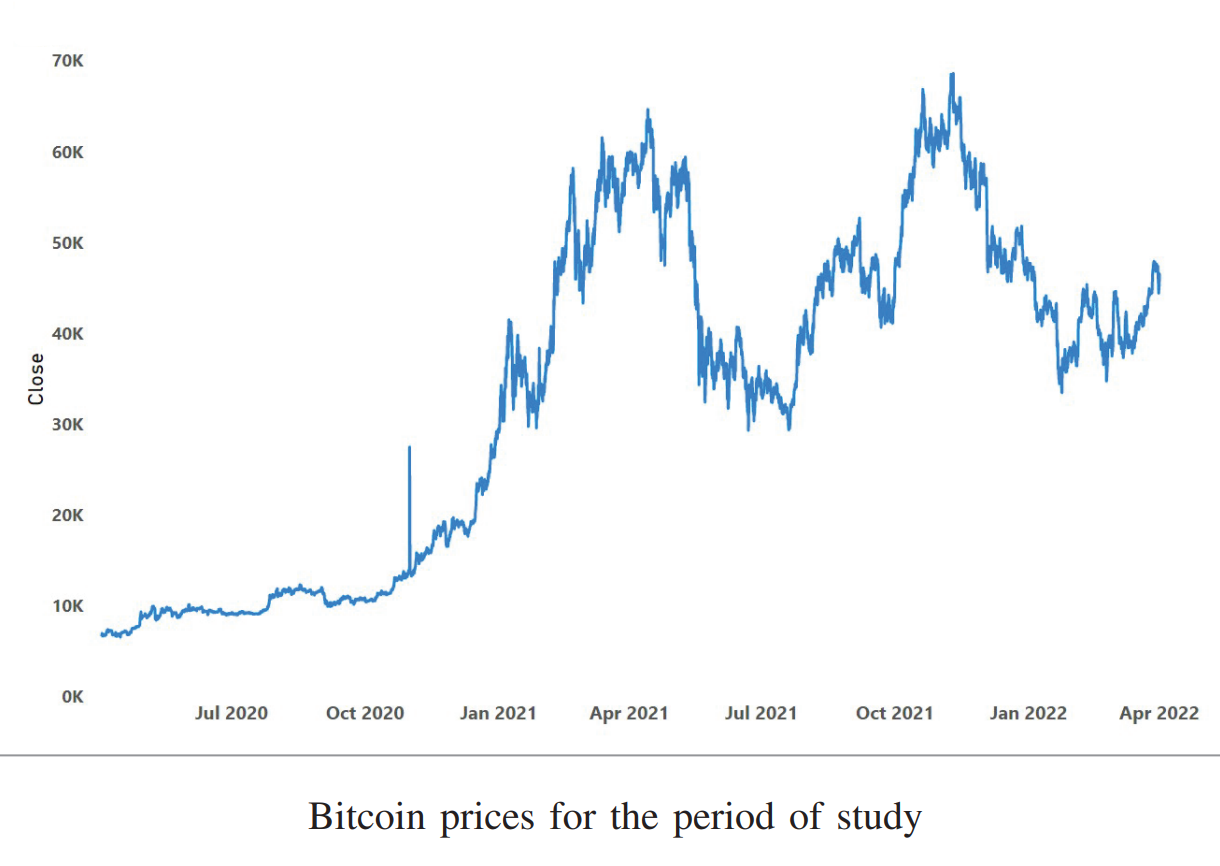

Cryptocurrencies have emerged as an alternative financial asset in the last decade, with their market growing exponentially in recent years. The price of cryptocurrencies is highly volatile and is prone to rapid swings within short periods of time. This behavior makes them a high-risk and high-return financial asset. The efficacy of neural networks in forecasting the high frequency financial time series has become widely accepted in the research community. This work explored the use of Long Short-Term Memory (LSTM), a neural network based non-linear sequence model, to propose a novel algorithmic trading strategy for cryptocurrencies. The proposed novel high frequency algorithmic trading strategy built over an LSTM based short-term price forecasting is used for Bitcoin and Ethereum. This simple, yet effective trading algorithm uses the network’s price forecasts to make buy and short selling decisions for cryptocurrency based on certain set criteria. The proposed trading strategy gives positive returns when backtested on Bitcoin hourly prices taken from yahoo! finance. We also verified the effectiveness of the trading strategy for Ethereum, the second largest cryptocurrency, based on the positive backtesting returns. As an extension to the study, the proposed strategy is applied on an even higher frequency (minute by minute) Bitcoin price data, and the strategy gives positive backtesting returns in this extended study. We also provide fuzzy intervals for the algorithmic return of our strategy and compare those with corresponding intervals on a simple buy and hold strategy.

Date and Time

Location

Hosts

Registration

-

Add Event to Calendar

Add Event to Calendar

Loading virtual attendance info...

- Contact Event Hosts

- Co-sponsored by R1 Buffalo Section

Speakers

Dr. Tulsi Thulasiram

Dr. Tulsi Thulasiram

Biography:

Dr. Ruppa K. Thulasiram (Tulsi) is a Professor with the Dept. of Computer Science, University of Manitoba, Canada. He received his PhD (Aerospace Eng.), from Indian Institute of Science and spent years at Concordia Univ., Canada (Mechanical Eng.); Georgia Institute of Technology, Atlanta, USA (Aerospace Eng.); and Univ. of Delaware (Electrical and Computer Eng.) as Post-doc, Research Staff and Research Faculty respectively before taking up a position at Univ. of Manitoba (UM) (Computer Science) in 2000. His current research interests include Computational Finance (CF), Data Science for Financial Applications (such as Option Pricing, Risk forecasting and etc.), Blockchain Technology for Financial Applications (DeFi – such as Cryptocurrency, Smart Contracts in Collateral Contract Services, etc.), Computational Intelligence (Bio and Nature-inspired Computing) in Finance, Cloud Computing (CC), and related areas. With his initial training in Mathematics, Physics and Applied Science, he has written many papers in the areas of High Temperature Physics, Applied Math., CF, CC, Computational Intelligence and Blockchain Applications research areas. He has graduated many MSc and PhD students and has received best paper awards in reputed conferences. His research has been funded continuously by the Natural Sciences and Engineering Research Council (NSERC). Canada. Tulsi is currently the chair of the IEEE Computational Intelligence Society’s (CIS) Computational Finance and Economics Technical Committee (CFETC). He has been an expert reviewer for research funding proposals from Canada, USA and Europe. Tulsi has developed curriculum for CF area and on CC for both graduate and undergraduate level and has been teaching these courses for the past several years. He has been serving on many administrative committees at UM and outside. Tulsi has organized many conferences and has been editor and guest editor with many journals.